34+ closing cost rolled into mortgage

Web Roll Closing Costs Into Mortgage Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service. In fact your lender should.

Which Mortgage Refinance Fees Are Negotiable Financial Samurai

Find A Lender That Offers Great Service.

. Roll Closing Costs Into. Compare Loan Options and Compare Rates. Ad See what your estimated monthly payment would be with the VA Loan.

Web Theres a host of downsides to rolling closing costs into your mortgage. Web An FHA mortgage loan is a type of home loan thats designed to make it easier for Americans to purchase a home to live in. Web It cost an additional six percent of the purchase price.

Web Closing costs for a purchase loan can typically run about 2 6 of the homes purchase price. Special Offers Just a Click Away. Web Closing costs are incurred once the seller transfers the property to the buyer.

It depends on the bank and it depends on ratios like loan to value and debt to income. Web A flock of fees known as closing costs on a new home are part and parcel of a sale. According to the Consumer Financial Protection Bureau CFPB the average VA loan closing costs in 2021 were 8391 while the average VA loan was.

Choose Smart Apply Easily. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. An example of a common closing cost would be a loan origination fee.

Odds are you wont be blindsided by the closing costs because your lender is required to give. That means for a 300000 mortgage VA closing costs could be anywhere from 3000 to 15000. Ad Get an Affordable Mortgage Loan With Award-Winning Client Service.

This is usually charged by the bank upon creation of the loan and often comes to about 1 of the mortgage. Web The closing costs in your FHA loan will be similar to those of a conventional mortgage loan. Web As your Primary Home refi charges such as closing costs or settlement costs were already added to the amount of your fixed and HELOC loans when you.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. FHA loans have flexible down payment requirements with most borrowers having to put just 35 of the purchase price down. Ad Get an Affordable Mortgage Loan With Award-Winning Client Service.

Ad COUNTRY Consistently Receives High Ratings For Financial Strength and Client Satisfaction. This is also known as rolling closing costs into a loan. Web The answer is not no.

Bank We Offer Helpful Tools and Resources For Navigating Conventional Home Loans. The other option is that if the 600k house appraises for at least 618k then you roll the 18k in closing costs. For example lets say your loan amount is 240000.

While conventional mortgages require a. When you get a new mortgage or a refinance loan youll usually need to pay closing. Web Closing costs can range anywhere from 3 6 of the price of the home.

Find A Lender That Offers Great Service. Rolling closing costs into your new loan is known as a no-cost refinance and may be a good strategy if your short-term priority is to keep more cash in your pocket. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

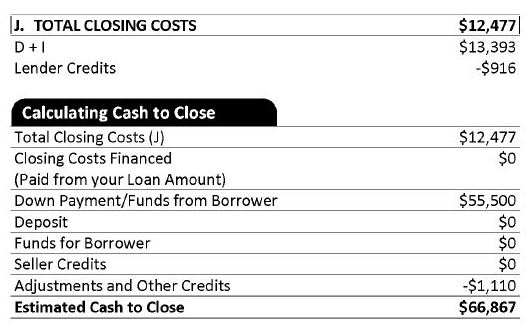

Web The other option is that if the 600k house appraises for at least 618k then you roll the 18k in closing costs into the mortgage. Closing costs usually end up being about 2-5 of the price of the property. Your loan estimate should include your closing costs so you know what fees to expect.

Web VA loan closing costs for a home purchase can be between 1 and 5 of the total loan amount. The loan amount would be exactly the same at 570k but we would be at 922 LTV instead of 95 LTV and would thus be able to dump PMI. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

FHA loans also have flexible credit requirements. They typically range from 2 to 5 of the homes purchase price. Compare More Than Just Rates.

These costs typically will be around 2 to 6 of the cost of your property. Sometimes you can sometimes you cant. Compare Loan Options and Compare Rates.

Ad We Offer Competitive Mortgage Rates Fees. In this scenario we would effectively put 48k down on a 618k house. Web You can get a barebones estimate of your closing costs by multiplying the loan amount by 3 6.

Get a COUNTRY Financial Home Insurance Estimate and protect your largest investment. Compare More Than Just Rates. So in the short end your closing costs can be rolled into an FHA loan.

The downside of rolling closing costs into a loan is that you. Web Yes closing costs can be included in a mortgage loan. But as long as you have a higher appraisal of the property you as the buyer can have the upper hand.

Web 34 closing cost rolled into mortgage Minggu 26 Maret 2023 Edit. Web Typically closing costs range from 2 to 5 of a borrowers loan amount. If you dont exceed any of the ratios and if your total loan amount is below the banks loan limits then you can often do it.

Sometimes for the initial mortgage its not possible while for a. USDA loans allow seller concessions up to 6 of the sales price. Now we will help you shortly on how to apply for your mortgage insurance.

Can Fha Closing Costs Be Rolled Into The Loan Fha Lenders

Calameo The Good News June 2010 Broward Issue

14 Best Historic Sites In Ireland 2023 Heydublin

Real Estate Page 9 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Estimating Closing Costs For Home Buyers And Sellers Homesmart

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Are Closing Costs Included In A Mortgage

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Real Estate Page 9 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Calameo The Good News May 2010 Broward Issue

Understanding Closing Costs Sirva Mortgage

29824 Real Estate Homes For Sale Homes Com

Mortgage Closing Costs When Buying A Property You Should Know

Inner Circle Due Diligence Doc Parigonpartners Com

Mortgage Preapproval Vs Prequalification How To Get Preapproved

How To Finance Your Closing Costs The Mortgage Reports

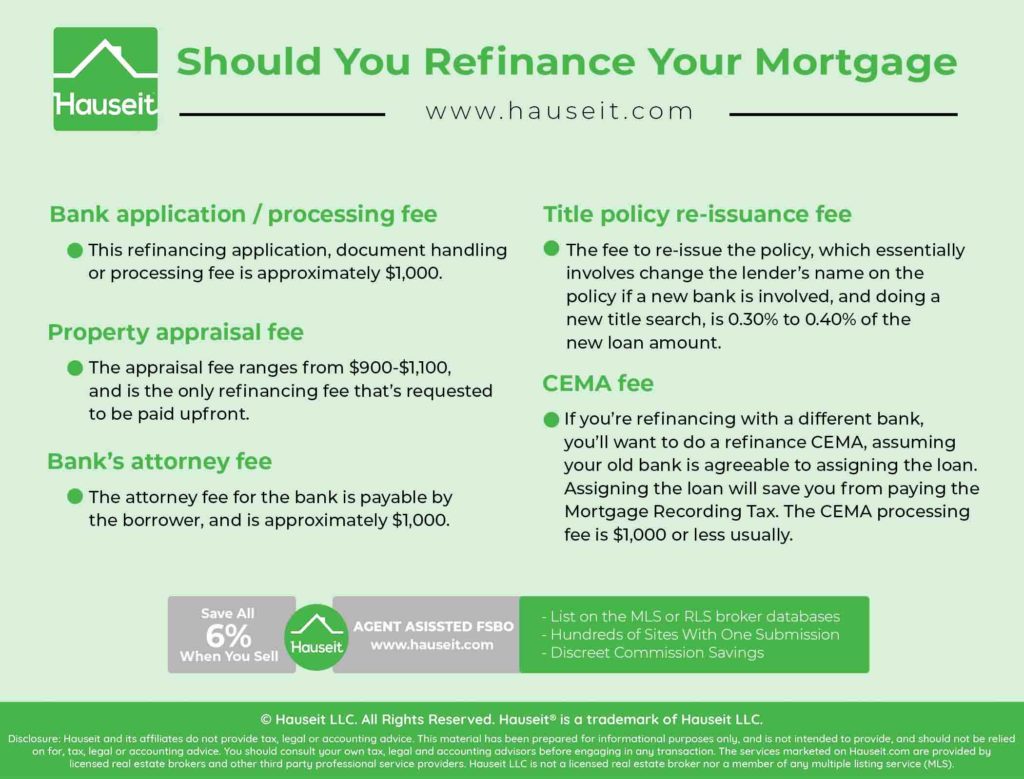

Should You Refinance Your Mortgage Hauseit Nyc